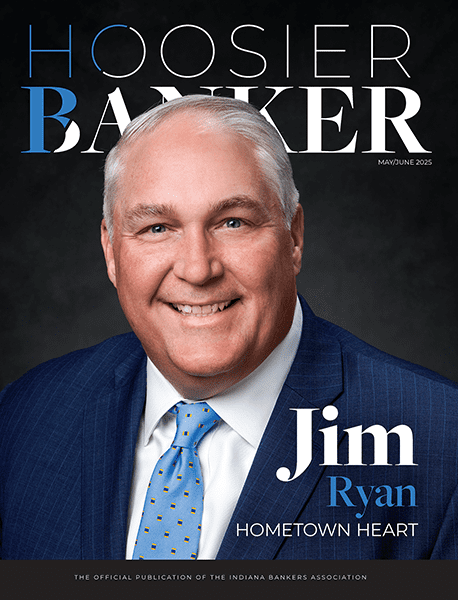

Hometown Heart

It’s hard to imagine James “Jim” Ryan III may have seen himself as one day becoming the chairman and CEO of a nearly $70 billion regional bank when he started his first job as a dishwasher at a 1950s and 60s-themed restaurant in Michigan, singing and performing the “Hand Jive” periodically throughout the night for customers (an experience he still remembers vividly). That job, though, reinforced what his parents had already taught him about the value of hard work: Ultimately, it doesn’t matter what your job is; if you work hard, success typically follows.

HELOC closing costs waiver

A banker asked if it was possible to conditionally waive closing costs for a HELOC contingent upon the customer maintaining the loan for at least three years. Our latest Compliance Connection dives into what Indiana law says about when conditions are and are not allowed to be attached to loan documents.

DEI & affirmative action

Shifting from a presidential administration that heavily encouraged DEI programs to one that has forbidden any such policy among federal agencies has given some organizations whiplash. Dive into compliance under the Trump administration.

National perspective

Our partners at ICBA discuss the impact that community banker grassroots advocacy has in Washington, while ABA celebrates its 150th anniversary.

BANKER PROFILE

Brit C. Hollopeter serves as assistant vice president and retail loan operations manager at Lake City Bank, Warsaw. She talked to us about what drew her to banking, how she defines success, the accomplishment she’s most proud of, what she’s been reading and listening to lately, and more. | Meet Brit.

Renewing the American Dream

U.S. Sen. Jim Banks has been named to the Senate Banking Committee. He says the Committee’s direction under the new administration will “cut red tape and unleash a new era of homebuilding that drives the cost of homes down for hardworking families.”

Digging deeper

Other articles from this issue include:

- Can margin improvement continue to improve for community banks in 2025?

- Consider using AI as a gamechanger for bold, audacious goals instead of incremental efficiency gains.

- A record-breaking turnout for the Future Leadership Division’s Day at the Statehouse.

- The 10-year rule for inherited retirement accounts is here to stay.

- Delve into the IBA’s 2024 Member Benefits Report.

Columns

Features

Prefer the flipbook? Read the entire May/June 2025 issue of Hoosier Banker magazine by clicking below!