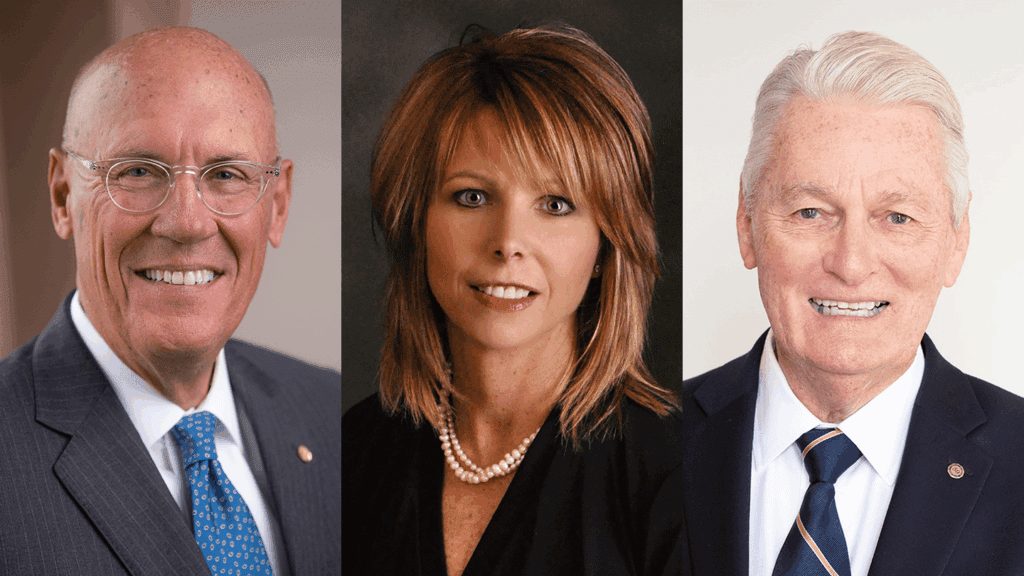

Leaders in Banking Excellence

Three outstanding individuals were honored by the Association for their exceptional contributions to banks and communities across the state. From Warsaw to Logansport to Huntington, these leaders are setting new standards of excellence. Meet this year’s honorees and learn about the impact they’ve had on Indiana’s financial sector.

Data rights and open banking

The Consumer Financial Protection Bureau estimates that 100 million consumers have authorized third parties to access their data. That data drives endless business decisions and capabilities. The CFPB’s proposed Rule 1033 would require financial institutions and other data providers to help consumers access and share their data securely using application programming interfaces.

National perspective

Our partners at the ICBA and ABA write about remaining nimble against government regulations and the “other” CRA.

BANKER PROFILE

We’re continuing our new series of introducing you to a Hoosier banker every issue, including how they got started, stories of how they overcame obstacles in their career, from where they draw their inspiration and more. Mollie Fry serves as director of wellbeing and Total Rewards at First Financial Bank, Cincinnati. She talked to us about the lifelong lesson she learned from cleaning toilets at her first job, how she stays innovative in an ever-evolving industry, and what she does for fun outside the bank. | Meet Mollie.

Faster payments, faster fraud?

It appears this idea is just a myth, at least for two community banks that participated in a recent Federal Reserve online town hall discussing fraud management strategies for the FedNow Service, including 1st Source Bank, South Bend. But don’t become complacent – continue evolving your fraud prevention practices, including educating your customers on how to spot would-be fraudsters from duping them into making instant payments.

Digging deeper

Other articles from this issue include:

- Indiana’s fair lending regulations;

- common FLSA mistakes and misconceptions about overtime pay;

- requirements and nuances surrounding branch closings;

- what you can expect from the new and improved IBA Regional Meetings this November; and

- state deposits in Indiana financial institutions.

Columns

Prefer the flipbook? Read the entire September/October 2024 issue of Hoosier Banker magazine by clicking below!